What is Life Insurance? A short guide on understanding the basics

In this guide NobleOak explains the fundamentals of Life Insurance and how to obtain the right type of cover to suit your personal circumstances for added peace of mind.

What is Life Insurance?

Life Insurance is an umbrella term used to describe the full range of insurance products that are designed to protect you and your family in the unfortunate event of death, severe injury, or illness.

The purpose of Life Insurance is to provide you and your loved ones peace of mind by easing the financial burden should one of these situations ever occur.

Life Insurance pays out a sum or sums of money upon the death, injury or sickness– depending upon the type of cover you have.

At NobleOak, we offer the four main types of Life Insurance:

- Life Cover (also known as Term Life Insurance or Death Cover)

- Total and Permanent Disability (known as TPD) Insurance

- Trauma Insurance (also known as Critical Illness) Insurance, and

- Income Protection Insurance

No matter what stage of life you are at, Life Insurance is an important consideration in order to give you financial peace of mind if you were to pass away, or if you had to live with a severe injury or illness. You and your loved ones would have the reassurance of knowing that the mortgage and bills could be paid, plans for the children’s education would be secure, or funds would be available to maintain your family’s lifestyle through providing an ongoing income.

How does Life Insurance work?

Life Insurance cover (also known as Death or Term Life Insurance) pays a set amount of money as a lump sum when you die. Most term life policies will pay out a lump sum of money if you are diagnosed with a terminal illness and given 12 months to live. If the payout is made and you recover, the money doesn’t have to be returned.

If you do die, the money will go to the people you nominated as beneficiaries, such as family members, who can then use it to help pay off debts. For instance, the money can be used to help clear a mortgage, household bills, fund the costs of the children’s education, or provide an ongoing income for a number of years. In fact, the funds in the event of a claim can be used for any purpose.

At NobleOak we offer comprehensive fully underwritten Life Insurance – this means when you apply for cover we ask you more health, occupation and pastime questions, and may require a medical examination. If the doctor’s report or blood test is required – we arrange these at our cost. This process can take a bit longer upfront, but most importantly, we take all the worry away so there is more certainty at claim time.

Life Insurance Premiums and Policy Renewal

Your premiums are calculated based on things like your gender, age, smoking status, occupation, health, and lifestyle status.

Your policy is renewed annually, with premiums usually increasing as you get older (commonly known as ‘stepped premiums’) and as your level of cover increases (commonly known as ‘indexation’), to keep up with inflation.

Stepped premiums

A stepped Life Insurance premium increases each year. The amount can vary in accordance with factors such as your age, gender and policy type. If you think this option is appropriate for your circumstances, consider how long you intend to hold the insurance for, to make sure you have sufficient funds to pay the increased fees each year and remain covered.

Level premiums

In contrast, a level premium typically does not increase each year with age, instead it is set at a more expensive rate in the beginning. Level premiums can increase over time owing to inflation or fee changes from your insurer, however the changes are likely to be minor compared to a stepped option.

When it comes to having more control over your personal insurance costs, level premiums may be a more suitable long-term choice as the cost is usually higher in the beginning phase but ultimately much cheaper than stepped premiums when you are older. This favours those people who intend to hold their insurance for many years to come.

NobleOak’s Life Insurance products use stepped premiums meaning your premiums will increase annually with your age.

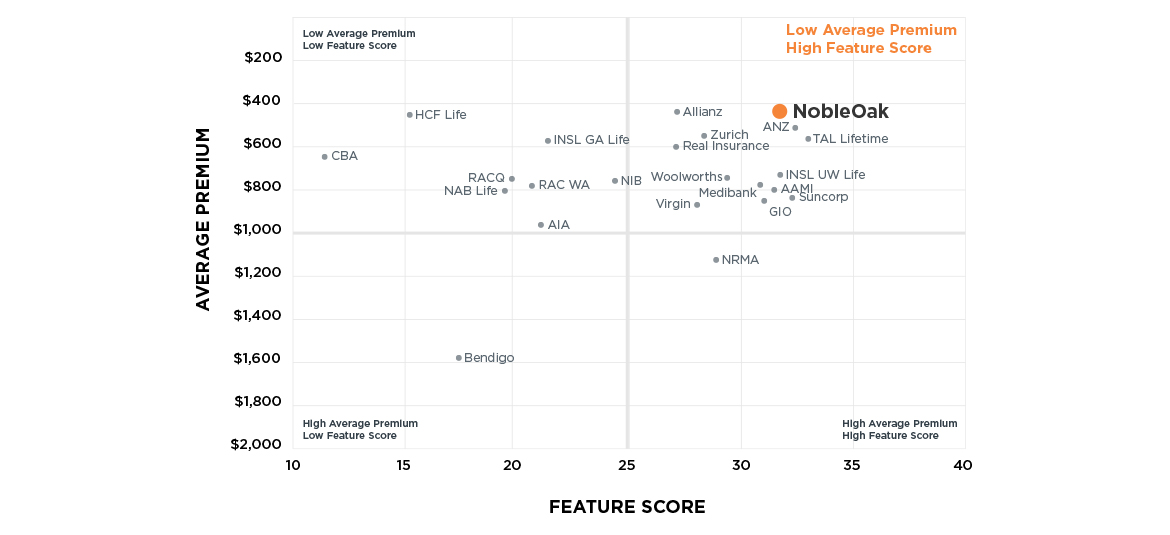

Compare average Life premiums with NobleOak against other leading life insurers in Australia.

How much Life Insurance do I need?

Having the right amount of cover is important. However, many Australian families remain underinsured.

If life took a turn for the worse, you wouldn’t want your family to suffer the additional stress of not being able to pay the mortgage or essential ongoing household bills, on top of dealing with the emotional distress that your loved ones would be experiencing.

Calculating the cost of Life Insurance

When selecting how much Life Insurance coverage you will need, it’s important to consider your level of debt and ongoing expenses, and the lifestyle you wish your family to maintain if you were to unexpectedly pass away.

For example, it can be helpful to think about your current household living expenses, your mortgage or other debt and the type of education and support you’d like for your children now and in the future. This can help you calculate the level of cover you will need to financially protect your loved ones.

A ‘rule of thumb’ people often use to calculate the level of Life Insurance (Death) cover suitable to them, is to multiply their salary by 10 to 20 times. People often use a higher multiple when they have younger children with high dependency.

If you’re responsible for looking after the home, you may need to consider the cost of accessing external childcare and home support to manage the household should you no longer be around.

Flexible Life Cover to suit your needs

The good thing about Life Insurance is that you can tailor the level of cover to your individual circumstances and then adjust it according to your budget. Above all, it’s most important to ensure that your loved ones are adequately financially protected.

With NobleOak, you have the flexibility to take out Life Insurance cover up to $15,000,000.

If you are still unsure how much cover you might need to protect your loved ones, our Life Insurance Calculator can help guide you. This free calculator has been tested by independent actuaries and researchers, Rice Warner. It’s available on our website and provides a comprehensive report with the level of cover options and explanations of each cover type.

When Is The Best Time To Buy Life Insurance?

If you’re moving up the property ladder or expecting a new addition to the family, you might start wondering about the need for Life insurance.

These types of life events often lead to thinking seriously about our emotional, practical and financial responsibility for ourselves and others, prompting us to take steps towards greater financial security.

In fact, our latest survey shows that changes in life circumstances are a key motivator (around 30%) for people purchasing Life and Income Protection cover.

Key changes in life circumstances

Examples of significant life changes that commonly trigger the need for insurance include:

Marriage

With marriage comes commitments and new responsibilities, and life partners will often take out Life insurance with each other as the beneficiary.

Having a child

This is a major life change with big responsibilities, and Life and Income Protection insurance become particularly vital during children’s formative years.

Divorce

Divorce can often lead to loss of income, and both parents having insurance can provide a financial safety net for children.

Buying a house

Most of us need a mortgage to buy property, and new (and existing) homeowners need to think about how the mortgage will be paid if anything happens to them.

Starting a business

Life insurance for a business owner could mean providing enough funds for the business to continue in the event of their illness/disability or death.

Other common reasons for buying Life cover

The second most common reason given in our survey (19.5%) was when renewal notices are received from the current insurer – perhaps prompting a policyholder to investigate other options more appropriate to their budget and circumstances.

10% also said they would likely buy Life insurance if a family member or friend experienced an accident or health event – which could prompt some people to think about their own vulnerability and mortality, and about what they need to do to protect loved ones. Major health events can include diabetes, heart attack and stroke, cancer and head and brain injury.

Are there other times to take out insurance?

There are other, less common times to consider taking out cover as well. For instance, it’s generally the case that Life insurance is cheaper the younger and healthier you are.

This means buying Life cover could be a good move even if you’re young and single, and buying your first home with family members as beneficiaries.

Income Protection is also usually less costly when you’re young and healthy, and could provide some financial security for loss of income due to accidents.

The death of a spouse or close friend or relative are also times when we naturally think about life insurance as the lump sum payment will help with funeral expenses as well ongoing living expenses.

So when should you buy Life insurance?

There is no right or wrong answer on when to take out cover – it’s a personal decision. However, if you have dependents, a large mortgage, or you are concerned about what might happen if you were ever unable to work due to illness or disability, then it’s probably time to consider it!

At NobleOak, we are very familiar with the various times in people’s lives that they start to think about Life and Income Protection cover. To find out how much cover is appropriate for your needs and life stage, use our online calculator, or get in contact with our team.

Differences in purchasing Life Insurance

One of the questions we get asked regularly is: What is the difference between purchasing Life Insurance directly, through advisers or within a super fund?

As an award-winning Life Insurer in Australia, NobleOak is well positioned to answer this question.

Buying direct

Buying Life Insurance directly means purchasing the insurance directly from the insurer without personal financial advice tailored to you. This means that any advice you receive will be general advice that does not take into account your objectives, financial situation or needs.

Some direct Life Insurance can be fully underwritten and some may not be. If it is not fully underwritten, it may be quick to apply for, but the types and levels of cover could be limited. There will also likely be exclusions for pre-existing conditions.

If you’ve decided to source your Life Insurance product directly through a life issuer, it’s worth doing your homework to check exactly what you are signing up for….and remember, it’s important that you consider the PDS.

Comparison sites such as Canstar and Finder can be helpful in showing the differences between policies. Direct Life Insurance can be very accessible and affordable for those that know how much and what cover they require, without paying commissions for financial advice.

Through a financial adviser

Purchasing Life Insurance through an adviser can suit people who are unsure of what type and amount of cover they need. The adviser may work with you in completing what is called a ‘statement of advice’ or SOA. With this information, the adviser’s role is to source the best cover for your needs and budget. They can essentially do your homework for you. The insurance is usually fully underwritten and high cover amounts can be obtained. However, it is important to know that purchasing cover through an adviser often comes with financial adviser fees built into the premiums.

Inside your super

Many people have their Life Insurance as part of their super fund. This will sometimes be referred to as ‘Group Life Insurance.’ Many super funds have ‘default’ insurance cover, meaning they include cover you did not select. Only Life Insurance, some TPD insurance and Income Protection can be included in your super – not Trauma cover.

Life Insurance through a super fund involves regular deductions which are passed on to the insurer. With Life Insurance through your super, cover can be limited and in the event of a claim, the payout would be made to a trustee. This typically leads to a more complex claims process and depleted super savings. The upside is there can be some tax advantages (but we are not tax advisers and you should speak to your accountant about tax).

At NobleOak, we offer Life Insurance directly to you, without adviser fees or high built-in overheads. Our products are fully underwritten and our Life, TPD and Income Protection cover can be purchased within an SMSF if required. We also offer Trauma cover.

Applying for Life Insurance cover with NobleOak

You can apply directly for cover online with NobleOak. The first step is to apply for a quote or call our Insurance Specialists on 1300 041 494. We can’t provide personal advice although we can offer general information to guide you through the process. If you know what level of cover you want, we can proceed with your application straight away.

The insurance is subject to the terms and conditions in the PDS which contains the relevant information including any exclusions.

For further Life Insurance information on topics in this guide, refer to NobleOak’s FAQ pages, or other fact-based websites, such as ASIC’s MoneySmart site. Alternatively, contact a member of the NobleOak team online or by phone.