The “Perceived” High Cost of Life Insurance Remains a Barrier to Purchase

Media Release: Thursday, 25 February 2020

47% remain unprepared when it comes to life insurance

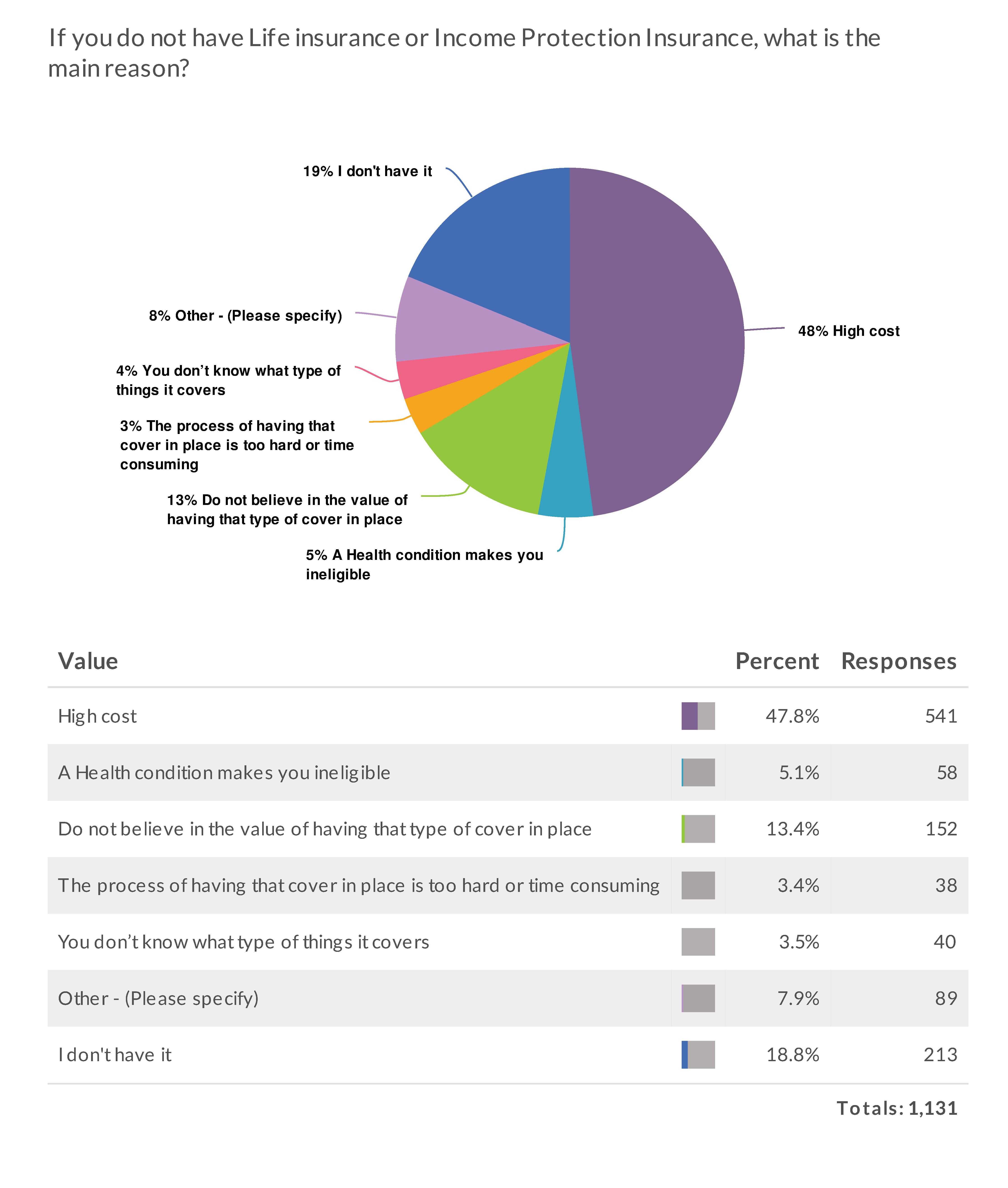

The latest findings from NobleOak’s annual Life Insurance industry survey indicate that the perceived high cost of life insurance is the main reason they do not have cover. 48% cite cost as the key barrier, whilst 47% of respondents are unprepared when it comes to Life Insurance.

NobleOak’s CEO, Anthony R Brown said:

“The insurance sector clearly has a job to do in demonstrating to customers that the premiums for life insurance products can be very affordable. Life insurance is very different to the likes of health insurance, whose premiums have dominated the headlines for the last few years. I recently sat in some focus groups and the participants were very pleasantly surprised when they saw how affordable our products were. Consumers understand the ultimate value in life insurance for their families, and they may be pleasantly surprised too by the premiums.”

Women (50%) were more price-conscious than men (45%). NSW respondents were most price-conscious at 50% and the least price-conscious states were Tasmania and ACT respectively. However, 13% did not believe in the value of having Life Insurance cover. Interestingly, the states that saw the least value were NSW and QLD. These results indicate the need to communicate the value benefits of Life Insurance to consumers.

The full 2020 report is available at https://new-staging.nobleoak.com.au/news-and-media/whitepapers/

About NobleOak Life Limited

NobleOak Life Limited (NobleOak), is one of Australia’s most established life insurers and has been in the Australian market for over 140 years. NobleOak is an independent insurer providing Life, TPD, Trauma, Income Protection and Business Expenses insurance.

For media enquiries, high res images and interviews, please contact :WordStorm PR – Kayla Tomlins, E:[email protected], T: 02 8272 3200, M: 0435850226