1 in 3 Life Insurance Consumers Likely to Shop Around After the Royal Commission

Media Release: Thursday, 26 February 2020

1 in 3 Consumers Likely to Shop Around After the Royal Commission

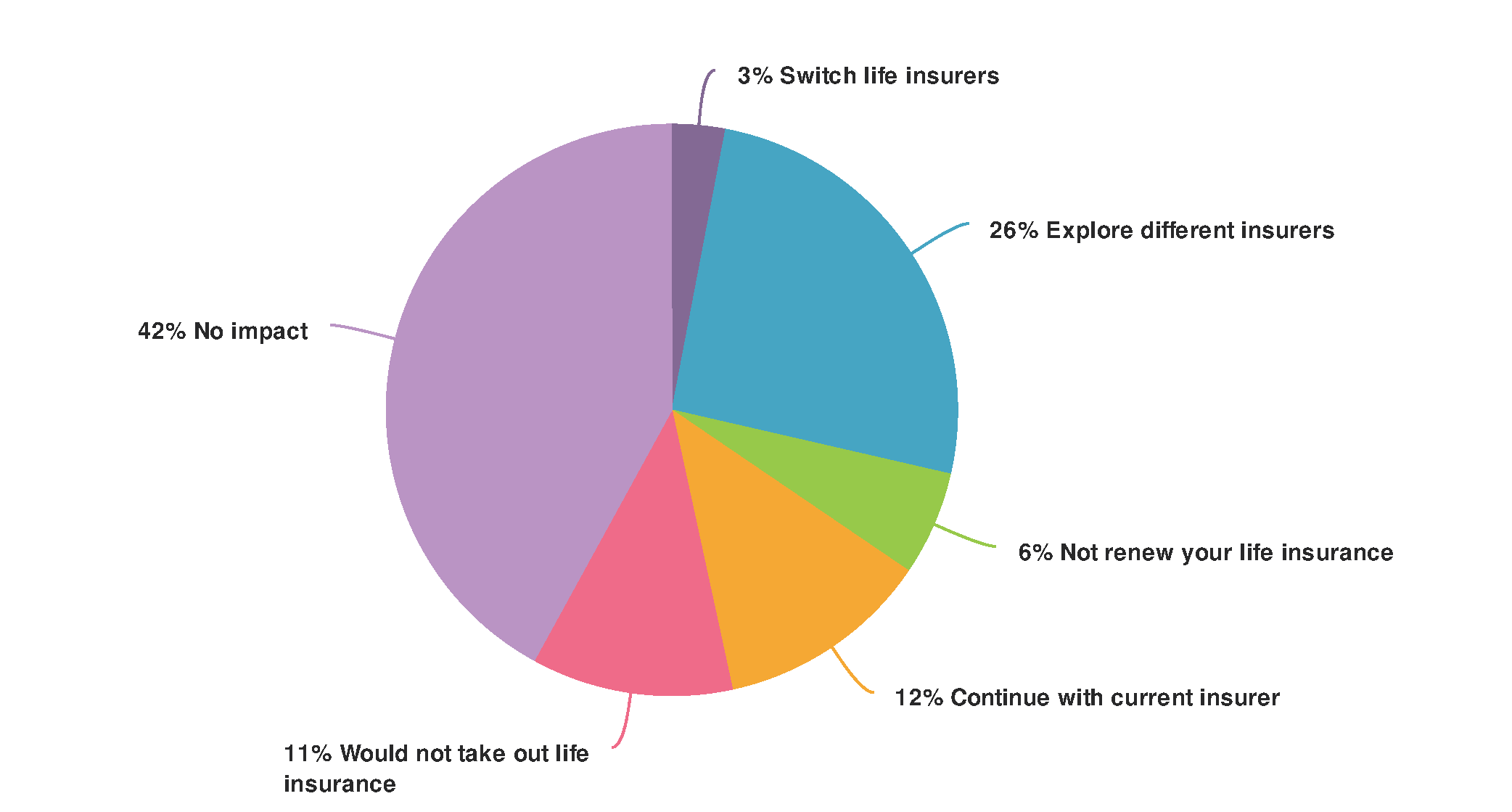

The latest findings from NobleOak’s annual Life Insurance industry survey say one third of respondents (34%) would either explore new Life Insurance (26%), switch from their current provider (3%) or not renew their life insurance (6%) in the wake of the Royal Commission.

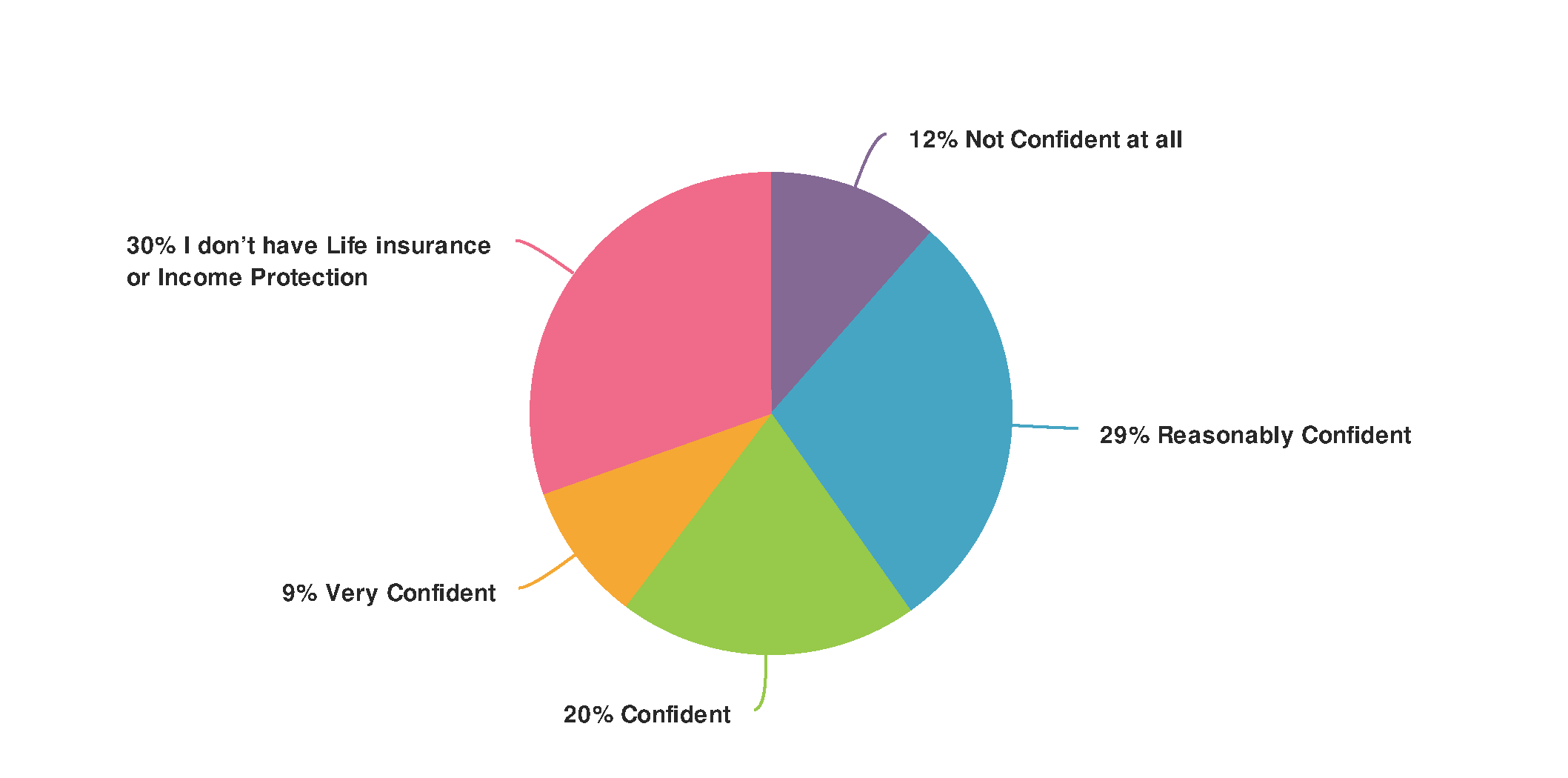

42% said they did not feel impacted by the Royal Commission in relation to their Life Insurance products and positively confidence remained high in the industry paying on claims, with only 12% having doubts their life insurer would pay out if needed. However, only 9% of respondents were “very confident” suggesting claims payouts are not taken for granted.

How will the findings of the Royal Commission impact your actions regarding life insurance?

How confident are you that your Life Insurer would pay your Life Insurance or Income Protection claim should it be required?

“he Royal Commission has clearly stimulated consumers to think more about their life insurance and reconsider their providers,” said NobleOak’s CEO, Anthony R Brown.

“It is important that Australians are proactively managing their insurance cover and as a brand that is striving to drive accessible, affordable, high-quality cover, this is something we are clearly pleased to see.”

The full 2020 report is available at https://new-staging.nobleoak.com.au/news-and-media/whitepapers/

About NobleOak Life Limited

NobleOak Life Limited (NobleOak), is one of Australia’s most established life insurers and has been in the Australian market for over 140 years. NobleOak is an independent insurer providing Life, TPD, Trauma, Income Protection and Business Expenses insurance.

For media enquiries, high res images and interviews, please contact: WordStorm PR – Kayla Tomlins, E: [email protected], T: 02 8272 3200, M: 0435850226